indiana estate tax form

No tax has to be paid. Indiana Personal Form Categories Indiana State Tax Forms 2021.

Simple Purchase Agreement Template Stcharleschill Template Real Estate Contract Purchase Agreement Pamphlet Template

This list should include any real estate financial holdings banking accounts and personal property in the individuals possession.

. The easiest way to complete a filing is to file your individual income taxes online. There is also a tax called the inheritance tax. The final income tax return of the decedent.

Listed below are certain deductions and credits that are available to reduce a. For your convenience we provide some of the personal form categories below. Inheritance tax applies to assets after they are passed on to a persons heirs.

219 326-6808 ext 2268 mschultzlaportecoingov. Estate income tax through the fiduciary income tax return if more than 600 was made by the estate. There is no inheritance tax in Indiana either.

For others please use our search engine. You can also order federal forms and publications by calling 1-800-TAX-FORM 800 829-3676. The amount of tax is determined by the value of those.

The estate tax rate is based on the value of the decedents entire taxable estate. Form 8971 along with a copy of every Schedule A is used to report values to the IRS. If you need to contact the IRS you can access its website.

Form IT-40PNR for Part-Year and Full-Year Nonresidents Use Form IT-40PNR if you and your spouse if married filing jointly. Some of the forms offered are listed by area below. You may even qualify to file online for free.

If you cannot find what you need contact Customer Service. Federal estatetrust income tax. Print or type your full name Social Security number or ITIN and home address.

Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note. A Current Assets List can be used when planning the distribution of an individuals estate. Many of the necessary determinations are done at the federal level by the IRS.

In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended. Estate tax is one of two ways an estate may be taxed. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption allowed for that beneficiary if the property transferred is Indiana real property andor tangible personal property located in Indiana.

Therefore you must complete federal Form 1041 US. Personal assets are calculated as the gross estate value minus any liens or encumbrances. Take a look at the table below.

Decedents residence domicile at time of death 5. Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax. The tax rate ranges from 116 to 12 for 2022.

These taxes may include. Appeal deadline is June 15 2021. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41.

Therefore you must complete federal Form 1041 US. Please read carefully the general instructions before preparing this return. Indiana Current Year Tax Forms.

Do I Need a Living Trust in Indiana. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Updated April 04 2022.

Find individual tax forms and booklets with instructions below or at one of our district. Step 3 Make a List of All Estate Items. This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax.

Property tax forms are managed by the Indiana Department of Local Government Finance not the Department of Revenue. Use Form IT-40 if you and your spouse if married filing jointly were full-year Indiana residents. Date of death 4.

Final individual federal and state income tax returns each due by tax day of the year following the individuals death. Senate Ave Indianapolis IN Telephone. However be sure you remember to file the following.

Please direct all questions and form requests to the above agency. Starting in 2023 it will be a 12 fixed rate. Of all the states Connecticut has the highest exemption amount of 91 million.

Inheritance tax was repealed for individuals dying after Dec. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. APPLICATION FOR PROPERTY TAX EXEMPTION State Form 9284 R10 11-15 Prescribed by Department of Local Government Finance Assessment date January 1 20____ County Name of owner claiming exemption Address number and street city state and ZIP code LAND IMPROVEMENTS BUILDINGS Legal Description Assessed Value Description of Improvements.

The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate. Social Security number 6. Forms downloaded and printed from this page may be used to file taxes unless otherwise specified.

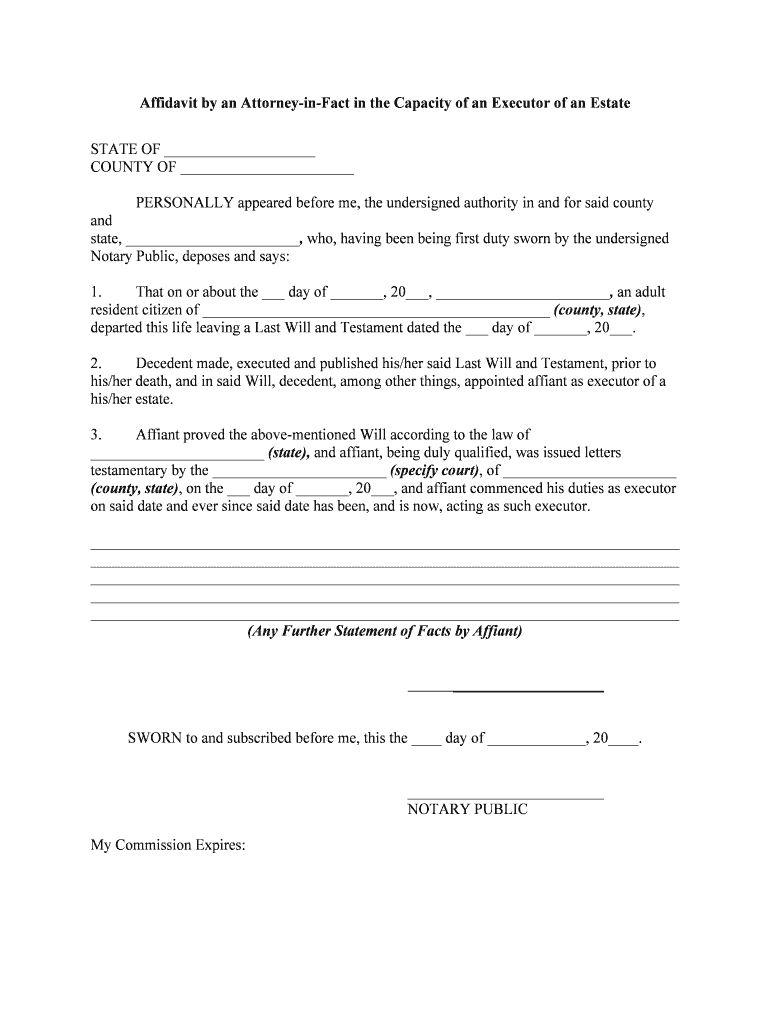

By making an organized list of all of the individuals property it. Does Indiana Have an Inheritance Tax or Estate Tax. The affidavit cannot be filed earlier than forty-five 45 days after the date of death and must be signed in front of a notary public.

Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property distributed or to be distributed from the estate if the estate tax return is filed after July 2015. We offer thousands of Indiana forms. SMALL ESTATE AFFIDAVIT 50000 INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT State Form R N.

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. All other properties appeal deadline is June 15 2022. Level and file Form IT-41 at the Indiana level.

Ditional amount it should be submitted along with the regular state and county tax withholding. Business or occupation 3. We last updated the Taxpayers Notice to Initiate a Property Tax Appeal in January 2022 so this is the latest version of Form 130 fully updated for tax year 2021.

Use this form to initiate a property tax appeal with your Indiana county. One Schedule A is provided to each. If you need to contact the IRS you can access its website at wwwirsgov to download forms and instructions.

Commercial and Industrial properties with an AV of 250000 and over appeal deadline is June 15 2021. Federal tax forms such as. INDIANA PROPERTY TAX BENEFITS State Form 51781 R14 1-20 Prescribed by the Department of Local Government Finance THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER.

Were Indiana residents for less than a full-year or not at all or Are filing jointly and one was a full-year Indiana resident and the. Indiana State Law 29-1-8-1 mentions that a trust is not necessary for a person to avoid the probate process if they have fifty-thousand dollars 50000 or less in personal assets. SMALL ESTATE AFFIDAVIT 50000.

Returns are processed faster refunds are issued in a matter of days and it is safe and secure. Please contact the Indiana Department of Revenue at 317 232-1497. State Form 54985 R3 4-18 INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT.

Indiana Inheritance and Gift Tax. Senate Ave Indianapolis IN 46204. You may file a new Form WH-4.

Property taxes owed by the decedent. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. An Indiana small estate affidavit is used to gather the assets of a person who has died and left behind an estate worth less than 50000.

Individual Income Tax Forms.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Letter Of Renunciation Executor Sample Fill Online Printable Fillable Blank Pdffiller

Basics Of Estate Planning Trusts And Subtrusts American Academy Of Estate Planning Attorneys Estate Planning Estate Planning Attorney Revocable Living Trust

Irs Form 56 Instructions Overview Community Tax

Executor Of Estate Form Pdf Fill Online Printable Fillable Blank Pdffiller

How Long Does A Speeding Ticket Stay On Your Record D Turner Legal Llc Speeding Tickets Records Ticket

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Illinois Quit Claim Deed Form Quites Illinois The Deed

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

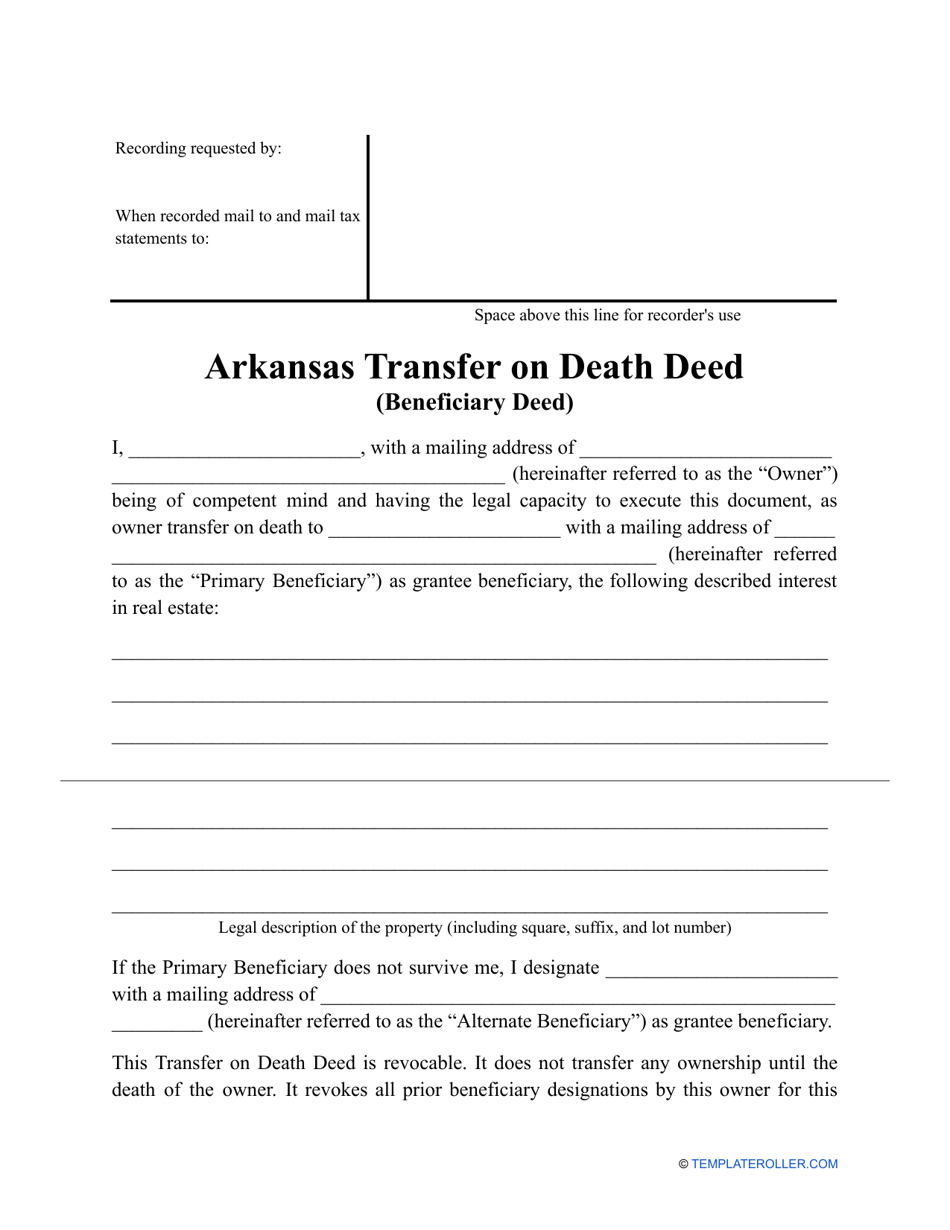

Arkansas Transfer On Death Deed Form Download Printable Pdf Templateroller

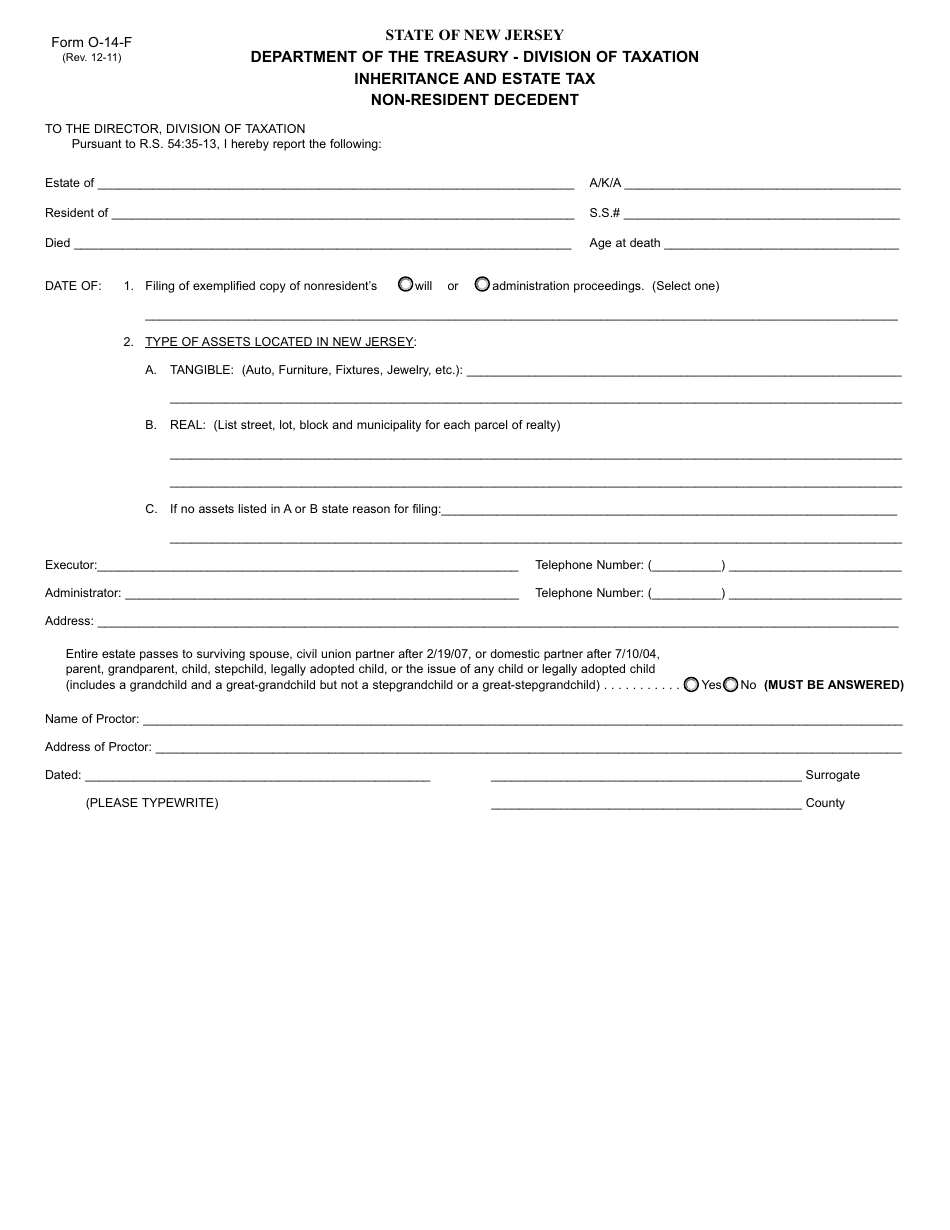

Form O 14 F Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Non Resident Decedent New Jersey Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

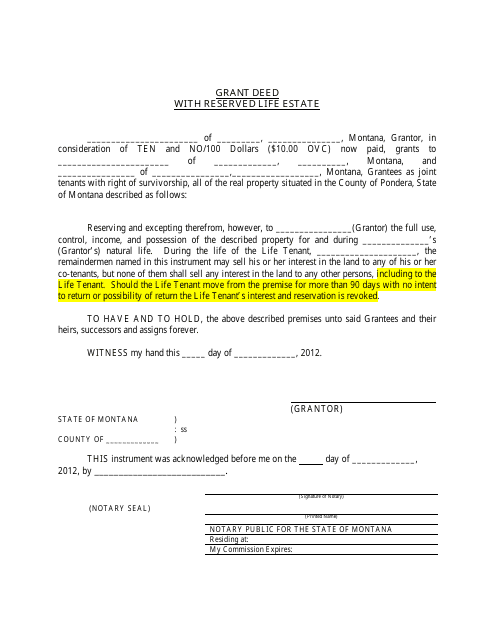

Montana Grant Deed With Reserved Life Estate Download Printable Pdf Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

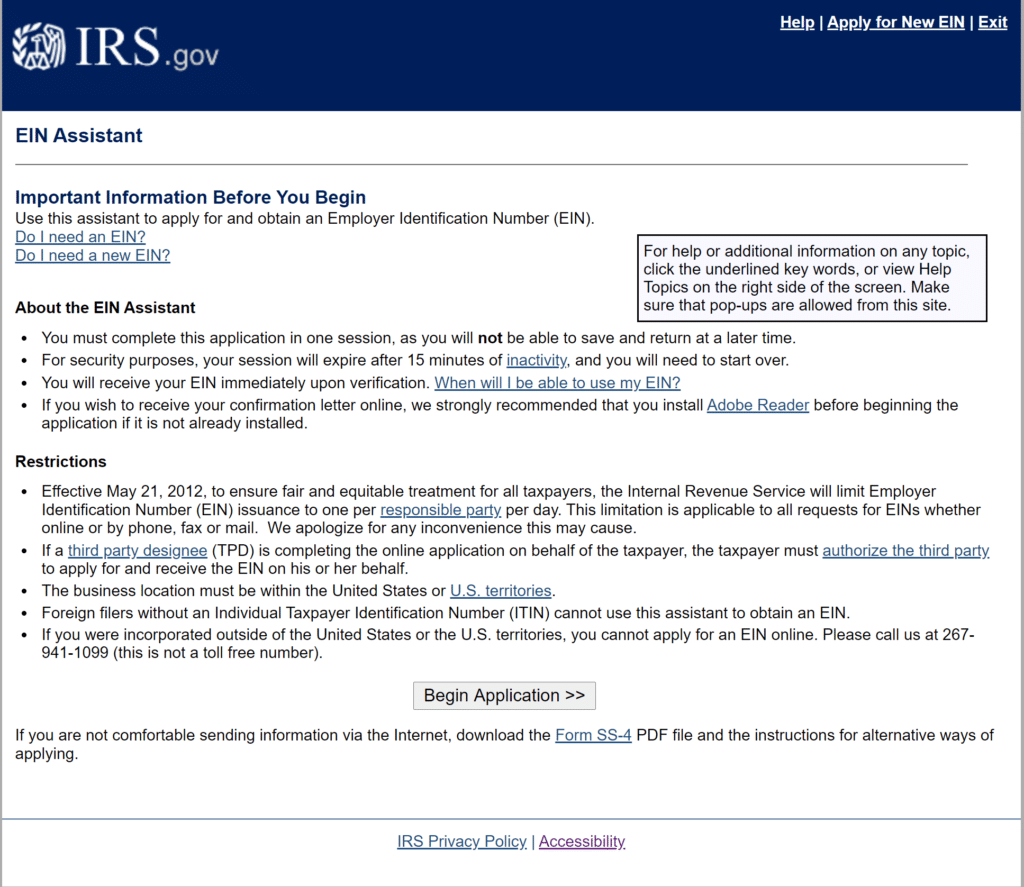

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes

3 11 106 Estate And Gift Tax Returns Internal Revenue Service